There’s never been a riskier time for streaming subscriptions to increase prices, but for the major streaming services prices have kept edging up, which could exacerbate the “keep or cut” debate happening in most households.

Since the start of the pandemic, virtually every streaming service has increased prices on premium ad-free packages. Netflix premium went from $13 per month in 2020 to $20 a month as of early 2023, with the new account-sharing feature set to cost an additional $2.99 per individual. HBO Max — recently rebranded “Max” — rose $1 to $15.99 per month in February.

Disney+ raised its ad-free tier from $7.99 a month to $10.99 per month late last year. Amazon raised the price of an Amazon Prime subscription in 2022 for the first time in five years, going from $119 to $139 annually or $14.99 monthly, which includes Prime Video. The monthly price of a standalone Amazon Prime Video subscription has stayed at $8.99.

Meanwhile, YouTube TV Premium spiked from $17.99 per month for the first three months then goes to $22.99 per month. In the case of YouTube TV, it’s more akin to a cheaper multi-channel cable TV model than subscribing to a single streaming content provider, but that fact is increasingly lost on consumers that have been nixing nonessentials for over a year. YouTube’s full premium package with access to over 100 channels is now $62.99 per month for the first three months, $72.99 per month after, and includes a far wider array of programming choices.

Platforms say that the costs of producing original programming and acquiring rights to films and series are behind the price hikes, but with recessionary economics causing budgetary introspection, it’s fair to wonder what will happen with subscribers this year.

According to the April 2023 “Subscription Commerce Readiness Report,” a PYMNTS and sticky.io collaboration, “Cost was the most common driver for cancellations, with 56% of consumers canceling a subscription in the previous 12 months for this reason.”

Additionally the latest “Subscription Commerce Conversion Index: Subscribers Seek Affordability And Convenience” found that over half of consumers (53%) paying for a streaming subscription and 48% of those paying for a membership “would cancel the service if unable to pay other essential bills. The key determinant of what constitutes a valuable subscription is often tied to its ability to fulfill its original purpose as consumers consider their options.”

Some services are cognizant that pricing must reflect the economics of local markets in price-setting. On its Q1 earnings call, Netflix CFO Spencer Neumann remarked on the platform lowering prices in 116 emerging markets, saying, “Think of this as kind of that next step in our evolution of bit of a better market product-market fit pricing fit, with the aim of growing our penetration in these markets and also better medium and long term revenue.”

Markets that saw price decreases collectively represent less than 5% of Netflix revenue.

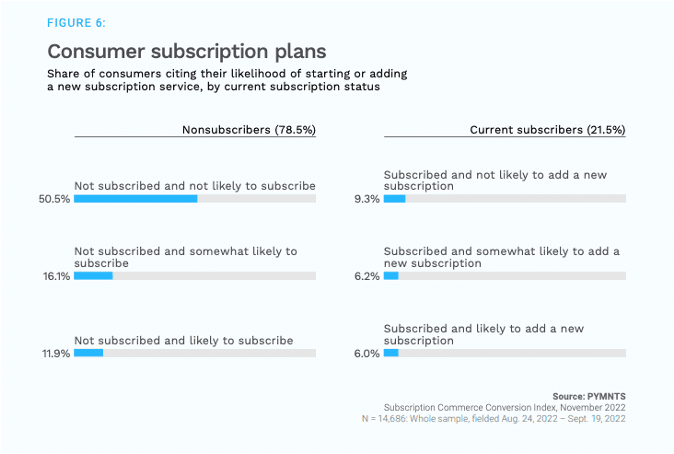

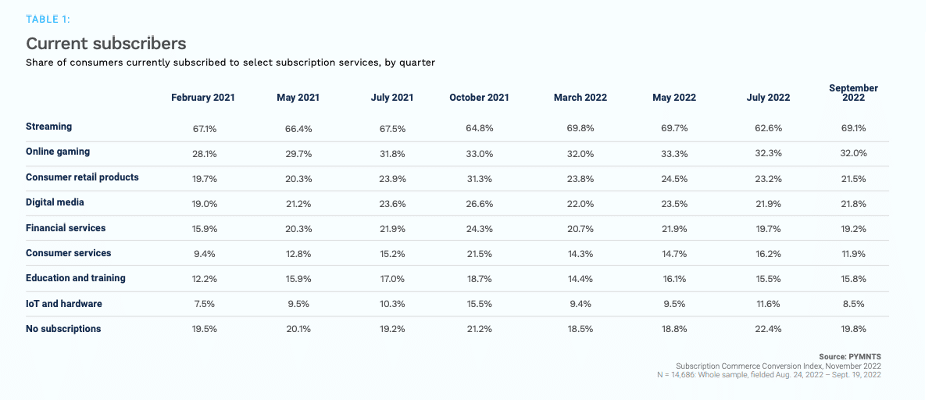

While PYMNTS research shows streaming subscriptions as being the most held type of subscription with 69% of households having at least one streaming subscription compared to 21.5% of homes using retail product subscriptions, price hikes, and cost-cutting may change that.

As The Wall Street Journal reported in mid-April, “For two straight quarters, cancellations have outpaced new subscriptions for digital memberships, food-of-the-month clubs and a host of other purchases, according to personal finance app Rocket Money. Streaming services have been particularly impacted, with cancellations for Netflix, Hulu and HBO Max, and others up 49% in 2022 from the previous year, according to subscriber-measurement firm Antenna.”