In recent years, several African countries where mobile money transactions are a popular means of payments have introduced levies on digital transactions, much to the dismay of local consumers and small businesses hit the hardest.

While those in favor of the electronic transaction levy (eLevy) on mobile money transfers argue that it creates an important revenue stream for governments in emerging economies and brings otherwise untaxed informal sector economic activity within the scope of taxation, the introduction of the tax in most markets has faced significant backlash.

Learn more: The African Mobile Money Tax Experiment

Countries like Ghana have stuck to their guns, but Tanzania’s government recently announced that it would drastically curtail the scope of the tax, effective from Oct. 1, following widespread public dissatisfaction with the country’s digital transaction levy introduced in July last year.

The East African nation introduced the fee on mobile money transfer and withdrawal transactions, excluding merchant, business, and government payment transactions, but following public criticism and a notable decline in the number of mobile money transactions, by September the government was forced to reduce the fee by 30%.

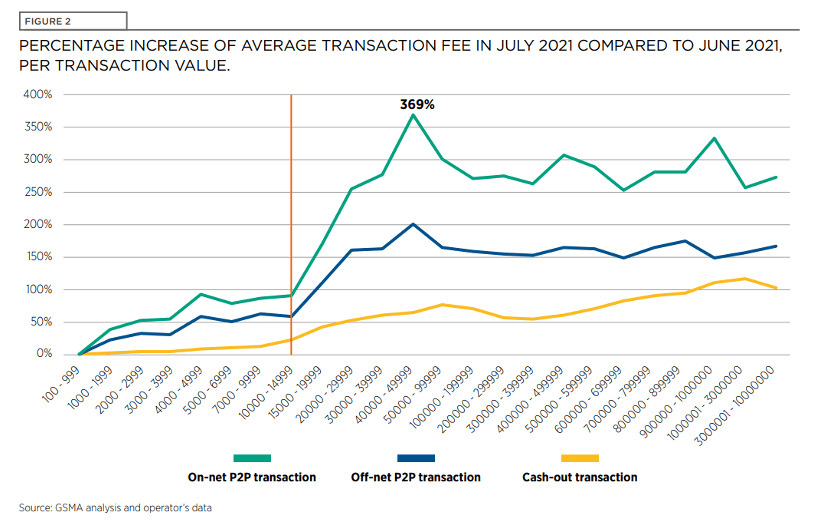

An analysis by GSMA found that after the introduction of the levy, the average mobile money transaction fee increased from 3% to as much as 369%, leading to a sharp decline in the volume of transactions being made.

Source: GSMA

While the analysis shows that Tanzania’s mobile money usage somewhat recovered after the September reduction in the levy, it still didn’t return to pre-July levels. And amid continuing opposition, the government announced a further 43% reduction in fees, almost a year later in August this year.

Related: Africa’s Digital Future Beyond Mobile Money

Now, in the latest change to the country’s tax regime, the levy is being scrapped entirely for transactions between banks and mobile money networks. Tanzanians will also wave goodbye to transfer fees on cash withdrawals from banks, mobile money agents and ATMs valued at Tsh 30,000 ($12.86) and below.

Other Countries Watch on With Interest

Outside of Tanzania, mobile money taxes have been controversial in other countries too, with critics voicing multiple objections.

In Ghana, which introduced its own 1.5% “e-Levy” on all mobile money transactions higher than 100 cedis (about $10) in May, the tax has been strongly opposed by the Mobile Money Agents Association of Ghana (MMAAG), a trade union that represents the country’s mobile money agents.

Read more: ‘eLevy’ Causes Mobile Money Concerns in Ghana

In a statement calling for the tax to be scrapped, the MMAAG argued that the eLevy threatens agents’ profit margins while being “very dangerous for the country’s digitization focus.” Like many critics of mobile money taxes, the MMAAG argues that the eLevy risks undoing much of the progress made in recent years by driving Ghanaians, looking to avoid additional costs, back to cash usage.

Read also: The Changing Face of Mobile Money in Ghana

What’s more, earlier this month, U.K.-based Institute of Development Studies published a research study showing that Ghana’s eLevy disproportionately affects the poorest members of society, who end up paying more of fees as a fraction of their income.

Ghana’s eLevy has also been opposed by the country’s largest opposition party, the National Democratic Congress. And with presidential elections scheduled for 2024, Tanzania’s decision to scrap mobile money taxes is likely to become a key talking point in the Ghanaian political conversation.

Meanwhile, in Cameroon, even the more modest 0.2% levy introduced at the beginning of this year elicited criticism in certain circles, with the hashtag #EndMobileMoneyTax trending on Twitter.

For other countries that have implemented similar levies, as well as those that are considering doing so in the future, Tanzania’s ultimate decision to backtrack on its mobile money tax serves as a warning of how widespread resistance to the measure can eventually force change.

For all PYMNTS EMEA coverage, subscribe to the daily EMEA Newsletter.