In the age of commerce that is always on, across borders and across currencies, in an age where the side hustle has now become the gig economy, payments are getting flexible and faster. The two-week paycheck may become, eventually, an anachronism. Any number of platforms and rails are striving toward getting fund flows to be real-time or instant – and, of course, safer and more transparent.

As noted in the Faster Payments Tracker, and to offer up just a few examples: the Federal Reserve is mulling the creation of its real-time payments system; The Clearing House (TCH) has its own real-time system, seeking critical mass among banks and in Australia, the New Payments Platform is logging new use cases.

Data:

Data:

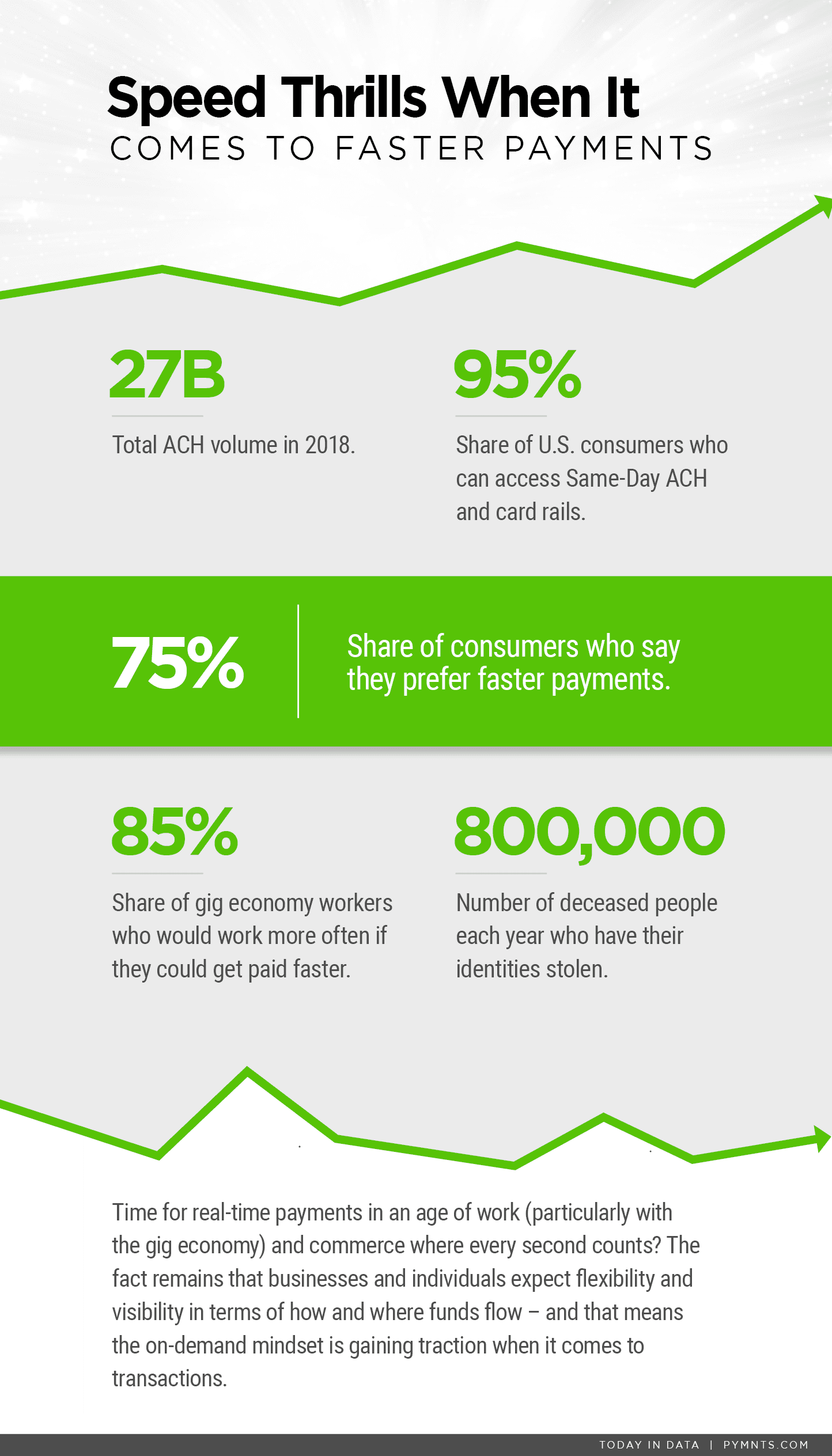

75 Percent: Share of consumers who say they prefer faster payments.

27 billion: Total ACH volume in 2018.

95 Percent: Share of U.S. consumers who can access Same-Day ACH and card rails.

85 Percent: Share of gig economy workers who would work more often if they could get paid faster.

800,000: Number of deceased people each year who have their identities stolen.