The paycheck-to-paycheck pain has us all reining in spending — and disconnecting a bit.

Literally.

And staying off the roads. And the electric scooters. We’re hailing Uber and Lyft drivers a bit less often too.

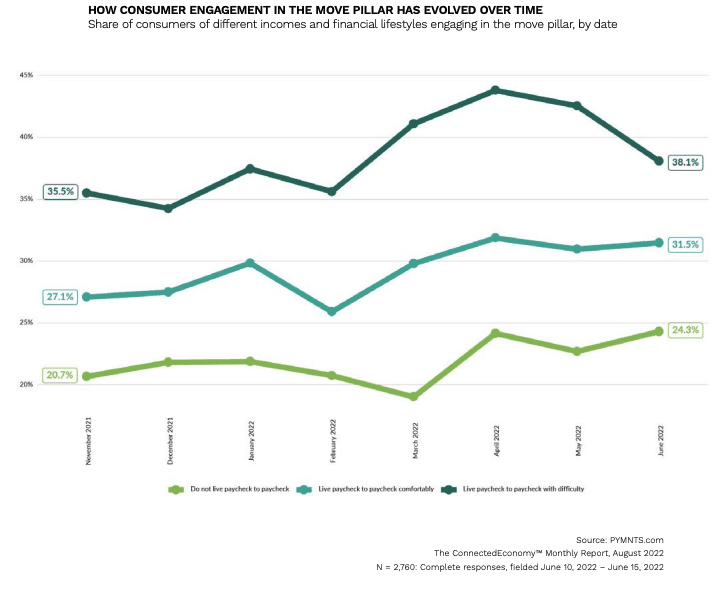

In the most recent ConnectedEconomy™ report, “Paycheck to Paycheck Consumers Digitally Disengage,” more than 2,700 consumers told PYMNTS that the financial pinch caused by inflation was enough to spur them to use travel-related apps and platforms less often.

That cuts across all use cases from ridesharing to micro-mobility — so much so that 16 million fewer individuals used those apps in June than in April. That means that paycheck-to-paycheck consumers are logging into those apps 11% less than they were earlier this year to get where they want to go.

The declines stand in marked contrast to use seen among consumers who don’t live paycheck to paycheck, where wielding those apps to park, hail rides or buy train tickets is on the upswing.

The declines stand in marked contrast to use seen among consumers who don’t live paycheck to paycheck, where wielding those apps to park, hail rides or buy train tickets is on the upswing.

Inflation plays no small role here — after all, when it’s tougher to cover the most basic expenses, it gets harder to cover the ancillary expenses.

Inflation plays no small role here — after all, when it’s tougher to cover the most basic expenses, it gets harder to cover the ancillary expenses.

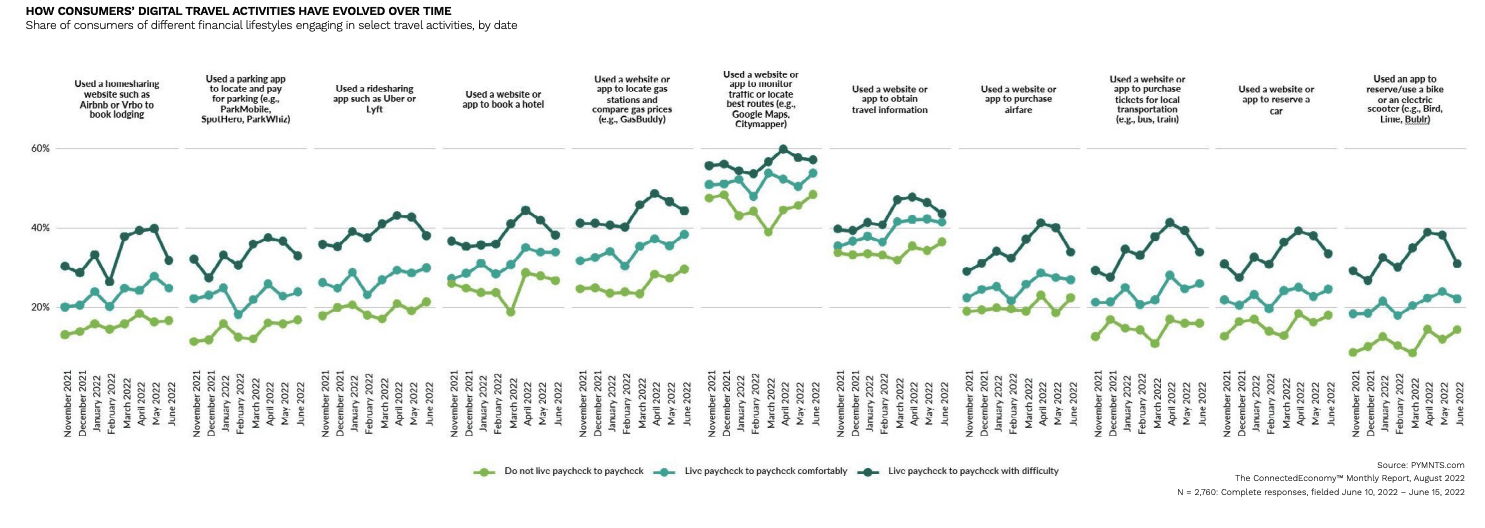

The work-from-home economy might naturally lead to a bit of a downturn in, say, purchasing train or bus tickets. But the graphic above shows that the most precipitous decline came in the rental scooter and bike apps segments.

One might argue that within transportation, these options are among the most discretionary (and maybe folks opt to walk instead).