Despite economic uncertainty and financial concerns, Americans have chosen to prioritize travel over savings this year. This trend applies to all generations, but it’s Gen X and millennial consumers who are driving the surge in travel expenses. Furthermore, rising inflation and high costs have pushed some individuals to defer their travel payments by using credit options, or alternatively adjusting their plans to still enjoy their holidays.

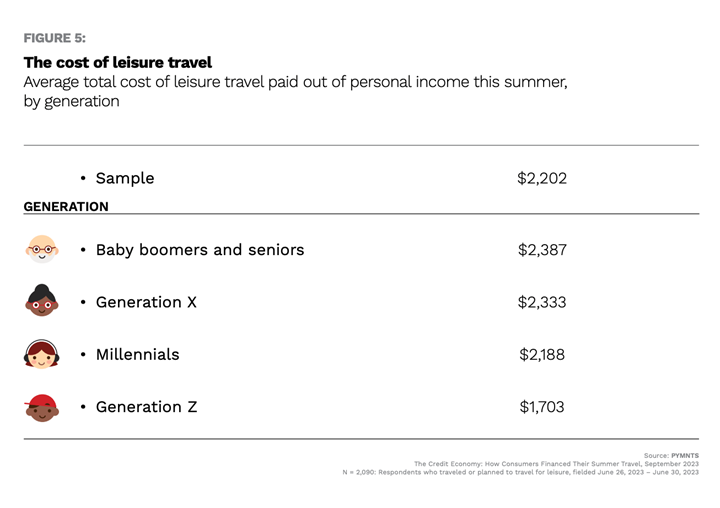

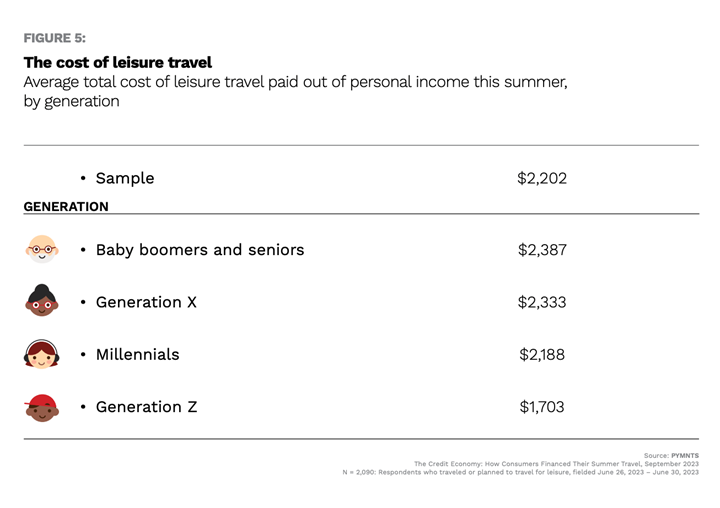

According to “The Credit Economy: How Consumers Financed Their Summer Travel,” a study by PYMNTS Intelligence and i2c that examines consumer attitudes and behaviors related to leisure travel spending, the number of leisure travelers increased by 22% compared to 2022. This growth is largely driven by Generation X and millennial members, who account for approximately 31% and 28% of this expenditure, respectively. Baby boomers spend the most on leisure travel, averaging $2,387 per capita, a similar level to Generation X members and about 10% more than millennials, although the latter two groups travel more frequently. Generation Z individuals close the list with the lowest spending per capita, with $1,703 on average, almost 30% less than baby boomers and seniors. This spending gap between older and younger generations can be attributed to disparities in purchasing power and debt burden across generations.

Financial health was an important factor in people’s travel plans this summer. PYMNTS Intelligence data shows that 42% of those who planned to travel more said their decision was driven by improved personal finances or increased job security.

While high earners are more likely to engage in travel, even paycheck-to-paycheck consumers are determined to spend on leisure travel, according to separate research conducted by PYMNTS and LendingClub. That study revealed that 30% of paycheck-to-paycheck consumers plan to allocate funds for travel.

The willingness to travel is strongest among older adults, and they are willing to adjust their plans to fit their budget when they have economic constraints. To finance travel expenses, baby boomers and seniors often turn to credit cards. In contrast, younger generations are more likely to choose other credit options instead of credit cards, and many admit going into debt to finance their summer travel. Around 30% of millennial and Generation Z consumers utilized buy now, pay later (BNPL) options for their summer travel, while only 5% of baby boomers and seniors did.

Regardless of economic fluctuations, the trendlines indicate that people will continue to prioritize travel. The widening spending gap between older and younger adults is evident in the divergent spending habits observed in recent years. While older generations tend to live in a healthier and more solvent financial situation than younger Americans, millennials and Generation X travelers fall somewhere in between. They do not spend as much on leisure travel as baby boomers or seniors, but they are more willing to travel, constituting the main spending group.

Advertisement: Scroll to Continue

See More In: BNPL, Consumer Spending, credit, Generation X, i2C, LendingClub, Millennials, News, PYMNTS Intelligence, PYMNTS News, travel, Travel Payments, travel spending