With all the brilliant and groundbreaking work that has gone into building digital wallets and payment platforms, it can be pretty easy to lose sight of an essential truth about most consumers and most merchants.

They don’t actually care if their payment methods become more digital or mobile.

Which isn’t to say consumers don’t care about digital payments — they just don’t tend to think of them in terms of how digital they are, instead caring much more about how fast they are, how easy they are to make and how secure the payment data they transmit ultimately is.

A quick glance at PYMNTS’ Checkout Conversion Index indicates that, in fact, consumers care very much about what that final step in the commerce journey is like. When the experience doesn’t deliver, they vote with their feet — or, more accurately, with their abandoned shopping carts.

“We’ve said this since day one,” Visa’s Senior Vice President of Digital Solutions Sam Shrauger told Karen Webster in a recent conversation about what’s next for Visa Checkout.

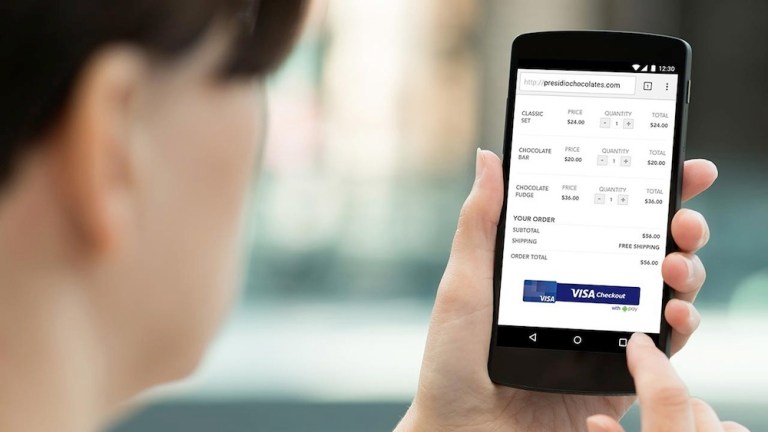

“Checkout is designed to really be mobile, first because we could see as clearly as everyone else could see the tremendous shift of shopping traffic that way — but not necessarily buying traffic. And the consumer’s expectation that they should be able to checkout with one thumb,” Shrauger noted.

Simple Is More Complicated Than It Looks

Shrauger remarked that expecting consumers to manage a series of different mobile wallets, or passwords or payments experiences is not simple — nor is it their preference. It’s why Checkout made the decision to enable other wallets to be used anywhere Visa Checkout is accepted, most notably Android Pay and Samsung Pay.

Shrauger says that helps to bring more users into the Checkout franchise, but, more importantly, it allows the user to have a more consistent experience across eCommerce destinations. Providing that functionality to the consumer isn’t coming at the expense of merchants who would otherwise have to do individual integrations to these wallets. Enabling Visa Checkout now permits acceptance of Samsung Pay and Android Pay without the strain of building out two additional integrations, while removing friction in the consumer’s digital journey regardless of the payments tool they chose to take with them.

“This is what great product design has to be about,” Shrauger noted. “Consumers don’t understand the complexity of enabling all of these payments experiences, and they don’t really want to. The key consideration for consumers is creating experiences for the life of the consumer that … will actually make sense to them.”

And about those merchants? Shrauger told Webster that conversation has also been evolving rapidly over the last year or so.

The Changing Merchant Perspective

Though the concept of “button fatigue” is most often applied to consumers, merchants with an ever-proliferating number of buttons angling for space on their page are susceptible to it as well.

“Us being able to say if you put in Checkout, you’ve added Samsung and Android Pay to your site as well — that eases a real pain point.”

But beyond stemming the pain, Shrauger noted that Checkout’s 20 million users are able to leverage the scale and scope of Visa’s network, and merchants are able to leverage those 20 million consumers, all of which creates the virtuous circle that drives sales and conversions.

“The [Checkout] network is growing and becoming more well-known and well-understood,” Shrauger noted. “We now have data on past performance and can point to how big a difference to the business Checkout can make. Conversations about sales and conversions [is] always a crowd pleaser.”

What’s Next

Visa Checkout, Shrauger noted, has been very focused in its acquisition of merchant partners — with a heavy skew to the top 500 players in the space. For a very good reason: It makes sense to go to the places where most consumers are spending most of their time and money. And from an eCommerce standpoint, that’s the top 250 players on the web.

Shrauger also said that without that group, Checkout has been focused on places where consumers interact frequently. So, not so much on the places where people may buy one or two times a year, but on apparel, home goods, QSR and order ahead — the things that, Shrauger said, people use in their everyday digital lives.

The better to build their digital payments habits around too.

Checkout’s goal, Shrauger said, is consistent with Visa’s overall goal: to be everywhere the consumer wants to be, but one step at a time.

“We want people to have the chance to use Checkout most of the time until we can get it to be everywhere all of the time,” Shrauger said.