Half of Brazilian consumers are adopting Click-and-Mortar™ shopping strategies, and the country trails only Saudi Arabia in the Click-and-Mortar™ transformation. The approach blends online and in-store shopping experiences through digital features and has rapidly gained traction worldwide. Brazil’s merchants have the opportunity to emerge as a leading market in feature adoption.

Highlighting the importance of Click-and-Mortar™ shopping trends is the widespread use of digital features across different income levels in Brazil. While more than 46% of high-income shoppers are Click-and-Mortar™ shoppers, 53% of lower-income shoppers have adopted this digital shopping strategy.

However, not everything is rosy. Many Brazilian consumers have trouble finding the digital shopping features they want to use.

These are just some of the findings detailed in the “2024 Global Digital Shopping Index: Brazil Edition,” a PYMNTS Intelligence report commissioned by Visa Acceptance Solutions. For this edition, we surveyed 2,200 consumers and 622 merchants in Brazil to capture recent trends in consumer behavior and document the rise of Click-and-Mortar™ shopping experiences. It also draws comparative insights from a larger survey of 13,904 consumers and 3,512 merchants across seven countries conducted from Sept. 27, 2023, to Dec. 1, 2023.

Other key findings from the report include:

Other key findings from the report include:

Brazil already boasts a robust Click-and-Mortar™ market, but there is potential for further gains.

In-store shopping has changed a good deal since 2020, reflecting the integration of digital features. The share of consumers engaging in Click-and-Mortar™ shopping experiences has increased 49% in Brazil since 2020. Despite in-store shopping’s commanding presence in Brazil, consumers who complete their purchases remotely or using Click-and-Mortar™ strategies report significantly higher satisfaction.

Brazil’s merchants can enhance consumer satisfaction by offering features consumers want.

Brazil’s merchants are on a positive trajectory to better meet customer expectations, with their overall feature failure rate — the odds that a consumer wants to use a certain feature while shopping but cannot in practice — improving from 52% to 50% since 2021. In Brazil, merchants do not offer 39% of the features consumers want. In addition, consumers have trouble finding many of the features merchants do offer. Merchants that add features consumers want and make those they already offer more accessible would likely foster greater feature engagement, boosting satisfaction.

Brazil’s merchants are on a positive trajectory to better meet customer expectations, with their overall feature failure rate — the odds that a consumer wants to use a certain feature while shopping but cannot in practice — improving from 52% to 50% since 2021. In Brazil, merchants do not offer 39% of the features consumers want. In addition, consumers have trouble finding many of the features merchants do offer. Merchants that add features consumers want and make those they already offer more accessible would likely foster greater feature engagement, boosting satisfaction.

The average Click-and-Mortar™ shopper in Brazil wants seven benchmark features.

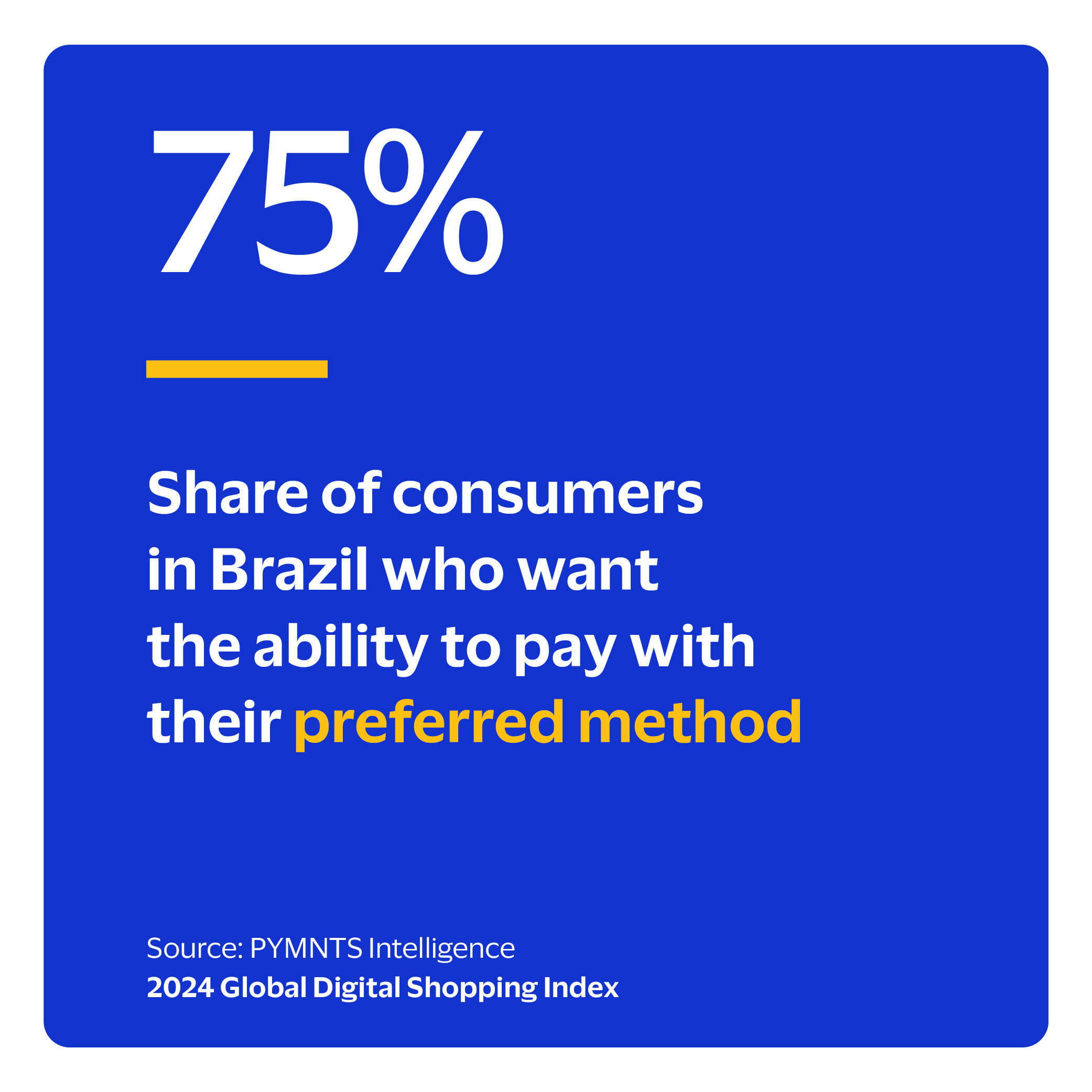

Brazil’s consumers have sent a clear signal to merchants: The ability to use preferred payment methods is a must, with three-quarters of Brazilian consumers demanding this feature. Two-thirds or more of the country’s consumers also demand easy-to-navigate online stores, digitally available product details and mobile apps or mobile-specific sites. Unfortunately, Brazil’s shoppers have expectations for digital features that outpace current offerings.

Merchants can make customers happier by focusing on the features that are most popular across demographic groups in Brazil. When customer satisfaction grows, loyalty and sales often follow. Download the report to learn about recent trends in consumer behavior reflecting the use of digital shopping features in Brazil.