As industry watchers point out, that change had been in the works for years. Other pundits will argue that it was only a matter of time before the digitally nimble Amazon finally caught up to the uber-accessible Walmart in the two-way tussle for retail supremacy. While Amazon dominates the web and Walmart is still king of the stores, the two rivals are endlessly striving to add top-line growth, no matter what channel it comes from.

But now, having been fueled by record online sales during the pandemic, Amazon has finally closed the gap and put itself into what is essentially now a dead heat with Walmart in the all-important market share metric.

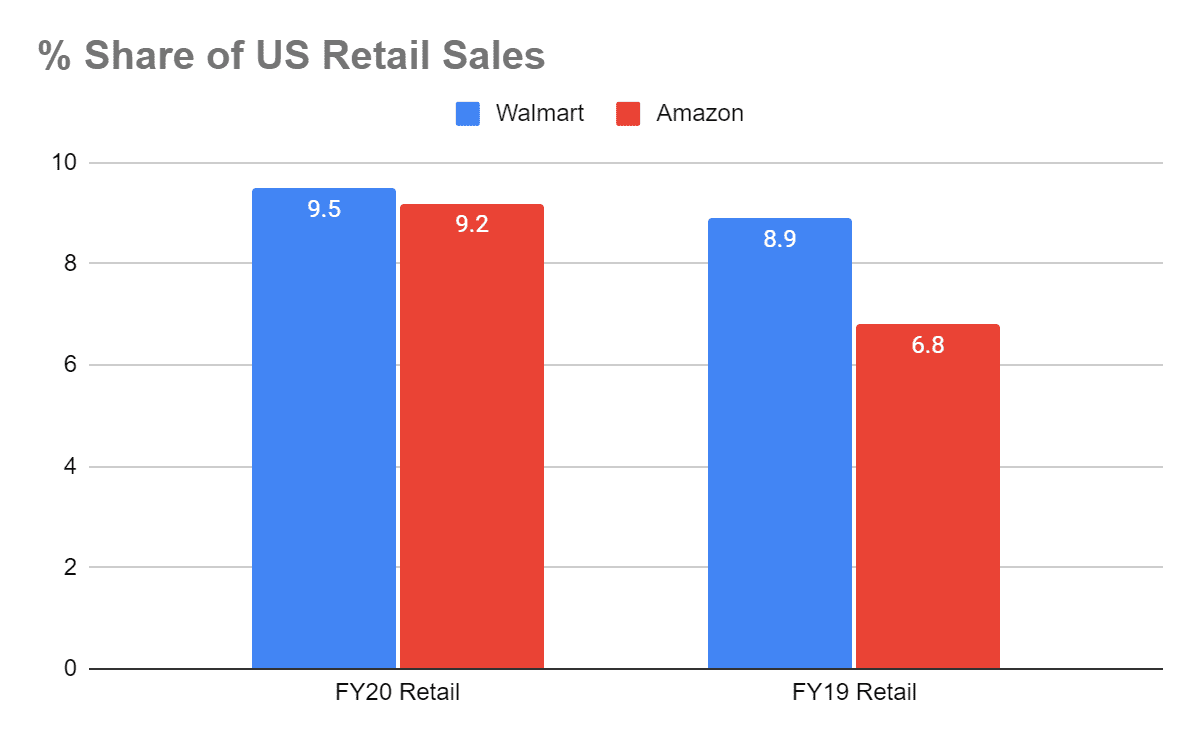

Specifically, proprietary data released this week by PYMNTS showed that the two titans of retail ended 2020 in approximately the same place, with both companies grabbing just over 9 percent share of total U.S. retail sales.

The finding is notable on several levels, not the least of which is the pace at which Amazon reached its new “tied” standing versus Walmart via a 9-plus percent share of retail. Last year alone, Amazon’s share increased by more than one-third from a less than 7 percent share it held a year ago. It has also quadrupled its share from just 2.2 percent in 2014, while Walmart consistently held steady at about 9 percent.

That said, Walmart’s share increase of 0.6 percent in 2020 marked its first year-on-year increase since 2015, and its largest annual improvement in at least six years.

Advertisement: Scroll to Continue

Finding New Growth

The newly tightened Whole Paycheck rivalry saw both companies taking measures this week to spur new areas of growth, efficiency and profitability.

On Monday (March 8), a regulatory filing revealed that Amazon had increased its stake in its air freight partner via a $130 million investment into Air Transport Services Group (ATSG). Amazon has owned warrants in ATSG since 2016 and was granted warrants as part of an agreement to lease 20 Boeing 767s to help flesh out its fleet.

Amazon has also made investments in rival carrier Atlas Air Worldwide Holdings, has bought mothballed planes from Delta and WestJet, and is preparing to open its $1.5 billion air hub in northern Kentucky, which has space for 100 Amazon-branded planes and is expected to take on around 200 flights every day.

Amazon also announced this week that it was venturing into the trendy contextual commerce business through its music site. The new, high-tech shopping experience is designed to make it easier for fans to find and buy merchandise from their favorite artists while listening.

Walmart Leans Into TikTok

For the second time in three months, Walmart has put together a celebrity-hosted livestreamed shopping event on TikTok, the fast-growing social media video platform that it almost bought with Oracle last summer in an odd, arranged national security deal with the former president.

In announcing its latest shopping show, Walmart CMO William White blogged that it was only the beginning of the company’s embrace of the new retail venue, which allows followers to join a live event and then tap items they see and like without leaving the so-called party to purchase them. White noted that when Walmart aired its December streaming commerce event, the company netted seven times more views than anticipated, and grew its base of TikTok followers by 25 percent.

“With that kind of demand and positive response, we’re going to give TikTok users more of what they want,” White added. “We are excited to test, learn and iterate on what’s best for users as we innovate and chart new territory in social commerce.”