Since the start of the pandemic, many consumers have settled into a new normal. Where once they ate at restaurants, they may now order in or cook at home. Where once they spent time perusing the aisles at grocery stores, they may now order delivery or opt for buy online, pickup in store (BOPIS). The question remains for retailers hoping to set themselves up for long-term success: how will these short-term shakeups affect the lasting routines of consumers in the post-pandemic world?

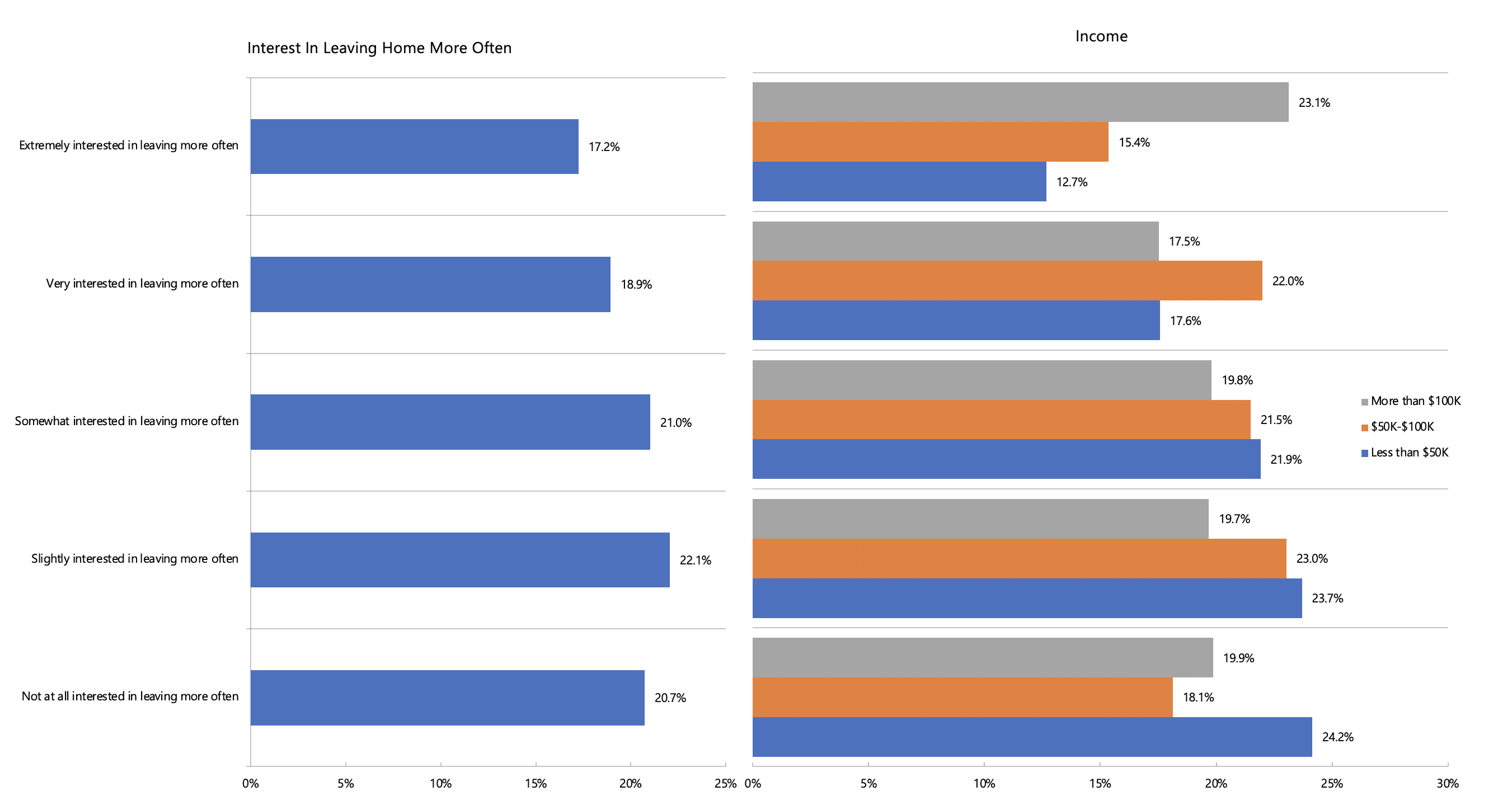

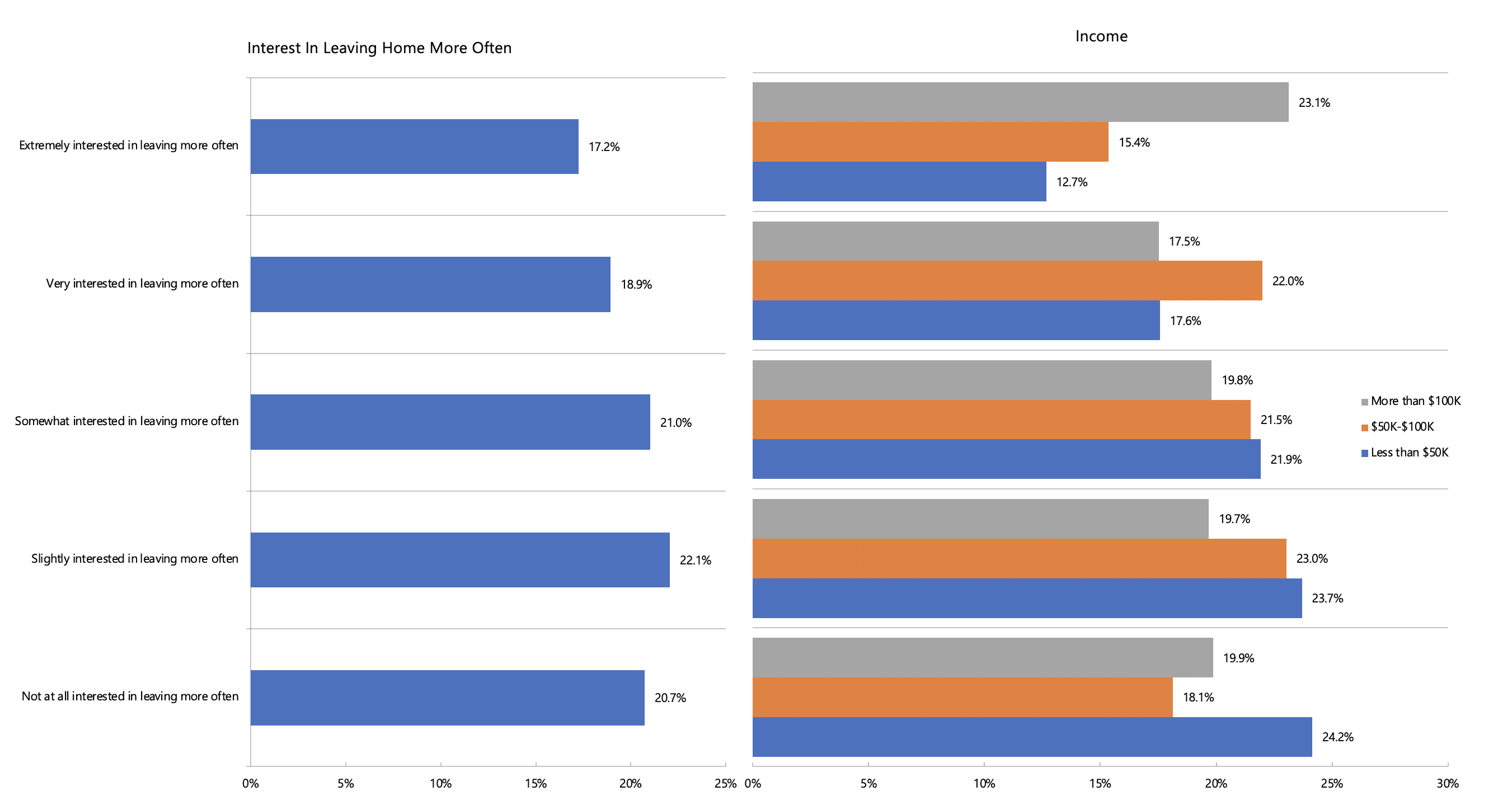

New PYMNTS research indicates that there is a huge amount of pent-up demand for experiences outside the house. According to our survey of over 2,000 consumers, 57.1 percent are somewhat to extremely interested in leaving home more often than they are currently able to, meaning that once it is safe to go out, there will be a huge demand for outside-the-home experiences in the near future.

As is, this is good news for businesses that provide those experiences. Even better, high-income consumers were the most likely to say that they were “extremely interested” in leaving home more often than they are currently able to, with consumers who make over $100,000 a year leading the category. For restaurants, this marks a huge opportunity, especially since high-income consumers tend to be restaurant enthusiasts, according to this month’s edition of the PYMNTS Delivering on Restaurant Rewards report, created in collaboration with Paytronix.

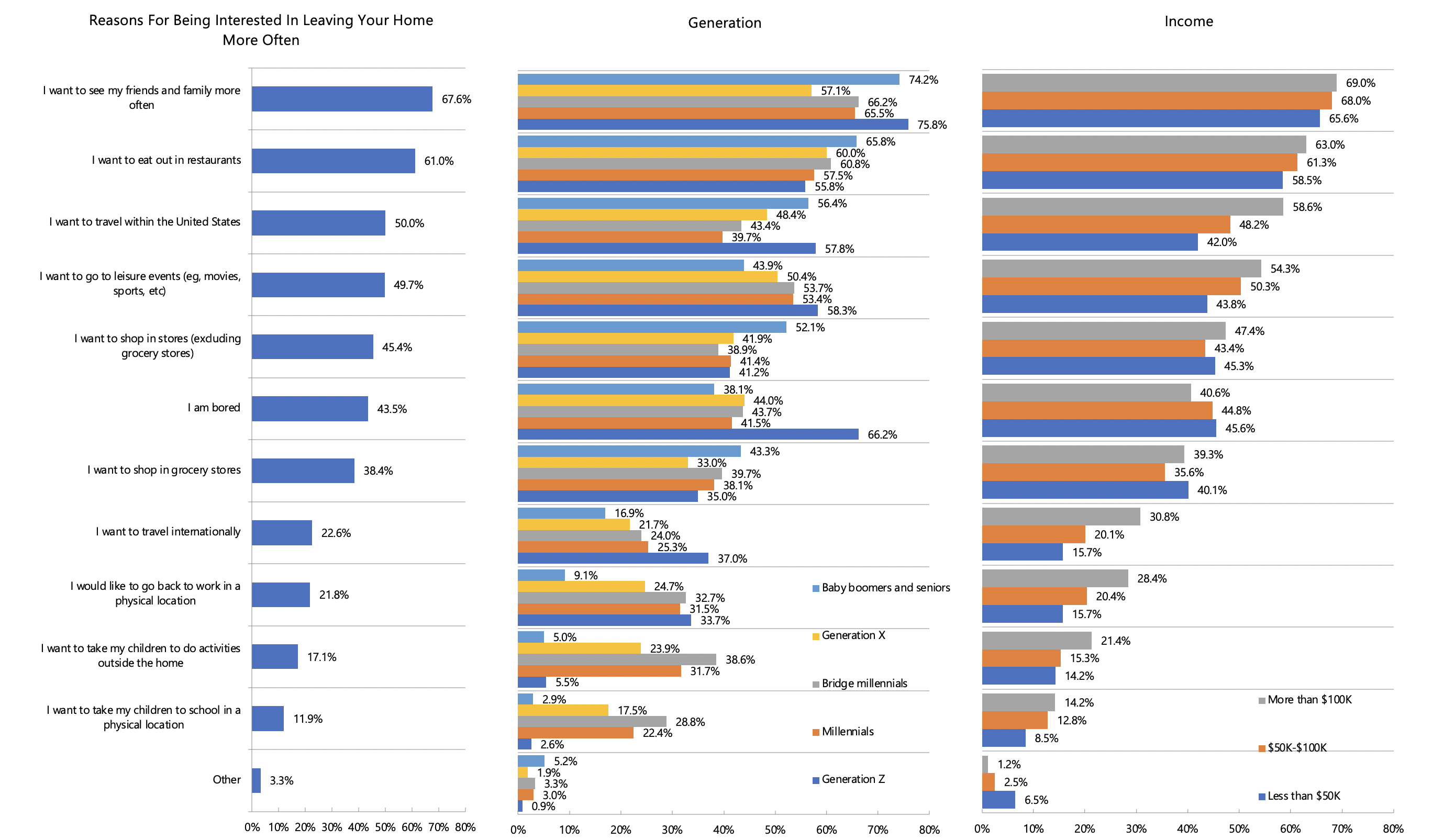

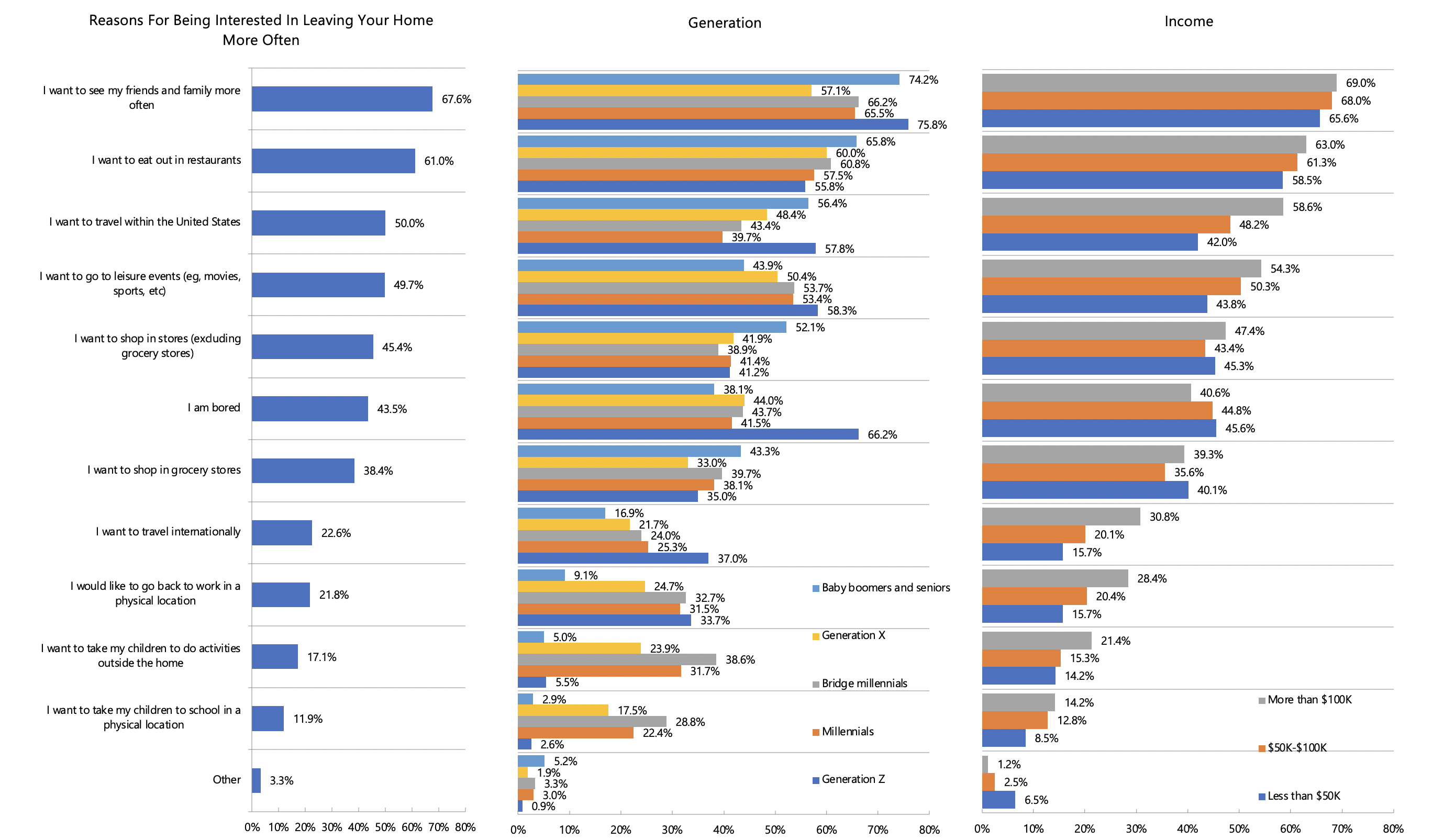

In fact, our research found that 61 percent of consumers are interested in eating out in restaurants more often than they currently do. Moreover, consumers who make more than $100,000 a year were the most likely to indicate wanting to eat in restaurants more often, shortly followed by consumers in the middle-income bracket, indicating that as consumers trickle back into restaurants for on-premises dining, many will do so with disposable income that they are excited to spend on meaningful culinary experiences.

Baby boomers were the most likely of all to report being interested in eating in restaurants more often, with each successive age group less likely, and Gen Z consumers least likely of all. Restaurants that offer foods that appeal to older consumers, therefore, rather than trendy fare that caters to social media-savvy consumers, may have the advantage in the post-pandemic world. More than half of all Gen Z consumers, however, are also interested in returning to on-premises dining, so there will be plenty of opportunity to benefit from the pent up demand of consumers of all ages.

Though restaurants may see a huge bump as on-premises dining becomes a safer option, grocery stores may not experience as major a spike. A significantly lower 38.4 percent of consumers indicated their interest in shopping in grocery stores more. This disparity makes sense, given the necessity of regular grocery shopping. Now, almost a year since the first lockdowns, most consumers have settled into a grocery routine that meets their needs.

Advertisement: Scroll to Continue

Not only will consumers’ grocery shopping methods remain fairly similar in the post-pandemic world — many of their purchases will also carry over. Consumers are spending more time in the kitchen during the pandemic, according to a recent survey highlighted in our How We Eat report, and many say the experience is broadening their culinary horizons. The survey found that 54 percent of consumers are cooking and baking more during the pandemic, 50 percent have discovered new brands and products and 51 percent expect their new cooking habits will last beyond the pandemic.

In an interview with PYMNTS, Debbie Guerra, executive vice president of merchant payments and payments intelligence solutions at ACI Worldwide, offered her perspective on the omnichannel future of the grocery industry. As Guerra told PYMNTS: “Let’s get real — grocery shopping has gone digital, and it has really accelerated … as a result of the pandemic … I think we’re going to see consumer journeys across omnichannel shopping experiences continue in the future.”

PYMNTS and ACI’s Omnichannel Grocery Report found that an increasing number of grocery shoppers are consistently turning to eCommerce for dry goods and non-food items. “I do believe that the hybrid models that have appeared during the pandemic are going to endure,” said Guerra, adding that the safety and convenience of eCommerce and the sense of immediacy and discovery of in-store shopping “have to work in concert.”

Read More On Restaurants: